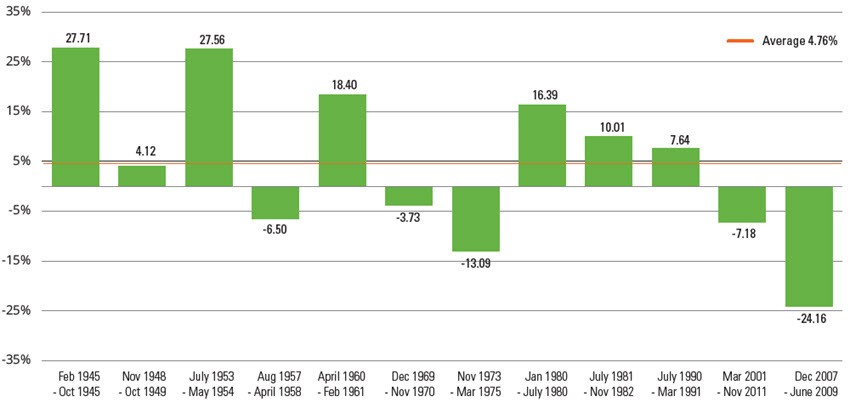

Stocks Have Posted Positive Returns During Recessions More Often Than Not

S&P 500 Index Performance During Recessions Since 1945

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. For illustrative purposes only. Data sources: Morningstar, Ned Davis Research, and Hartford Funds, 3/20.

As you have likely noticed, the volatility of the market has reduced dramatically over the last 4-6 weeks. Although the stock market has improved somewhat during this period of time, we believe there is still opportunity for additional volatility on the horizon as many economies begin to open and we move closer to our election in November. As you have likely heard us say many times, markets do not like uncertainty. However, we encourage you to remember the work we have previously done to understand your risk tolerance, and provide historical data and perspective on risk. We encourage you to continue staying focused on your long-term goals when listening to the headlines, and know that we are always available if you would like to discuss how this is impacting your individual accounts. We continue to believe that the market will recover (like it has in the past), and we appreciate your trust in us to help you navigate through these challenging and changing times.

Our team is now back in the office, and taking extra precautions to stay safe and healthy. As your meeting time approaches in the future, we will be in touch to determine if you would like to meet in our office (our conference room table is large enough that we can sit six feet from you), or if you feel more comfortable conducting a “Zoom” meeting from the comfort of your home. We are happy to adjust our meeting to whichever venue you prefer – we want you to feel safe, but have the opportunity to discuss your financial plan and portfolio.

We are grateful for your support and your business, and we will continue to pray for your health and safety.

The S. Harris Financial Group

Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC. S. Harris Financial Group is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment advisory services offered through S. Harris Financial Group.

Raymond James Financial Services does not accept orders and/or instructions regarding your account by email, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. Email sent through the internet is not secure or confidential. Raymond James Financial Services reserves the right to monitor all email.

Any information provided in this email has been prepared from sources believed to be reliable but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in this email. This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.

Any opinions are those of S. Harris Financial Group and not necessarily those of Raymond James.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

1 The National Bureau of Economic Research (NBER) is the organization responsible for identifying economic cycles. The definition of a recession used to be two consecutive quarters of decline in real GDP, but is now more nuanced: Extended diminishing activity in real GDP (an inflation-adjusted measurement of the value of all goods and services produced by an economy), real income (inflation-adjusted measurement of how much money an individual makes), employment, industrial production, and wholesale-retail sales output.

2 Personal Consumption Expenditures/Gross Domestic Product, Federal Reserve Bank of St. Louis, as of Q42019

3 Data source for recession statistics: NBER unless otherwise noted.

4 “Collapse and Revival: Understanding Global Recessions and Recoveries,” Ayhan Kose; Marco Terrones, IMF 2015

5 “Do longer expansions lead to more severe recessions? No, say Cleveland Fed researchers,” Federal Reserve Bank of Cleveland, January 2019

Important Risks: Investing involves risk, including the possible loss of principal.

A recession is defined as “a period of temporary economic decline during which trade and industrial activity are reduced, generally by a fall in GDP in two successive quarters.” The recent estimate documenting decline of GDP in the first quarter of 4.8% was, in part, due to the response to the spread of COVID-19, as governments issued “stay-at-home” orders in March. This led to rapid changes in demand, as businesses and schools switched to remote work or canceled operations, and consumers canceled, restricted, or redirected their spending. It is highly likely that we will see even more significant negative GDP results for the second quarter, which will officially put us in a recession.

A bear market is not a recession and nine other important things to know about economic contractions.

1. |

What’s in a name?: A recession is an extended period of declining economic output, wages, employment, industrial production, and retail sales.1 |

2. |

A recession is not the same as a bear market: The economy is not the stock market. The stock market is based on expectations for the economy in six to 12 months, so stocks can move up during a recession—or down when the economy’s expanding. By contrast, economic recessions or expansions may not be identified until months after they begin. |

3. |

Internal versus external shocks: Recessions can be started by imbalances in the economy, such as a financial crisis; these imbalances usually must stabilize for the recession to end. They can also be started by the economy’s reaction to external shocks, such as a pandemic or a terrorist attack. |

4. |

The customer is always right: Consumer spending accounts for about 70% of US economic activity, which is why there’s so much concern that social distancing and quarantine measures due to the COVID-19 pandemic will have a negative impact on the US economy.2 |

5. |

What goes up must come down: Recessions and expansions are a normal part of the economic cycle. There have been 12 recessions since 1945, occurring about five years apart on average.3 |

6. |

We grow more than we contract: On average, US recessions have lasted about 11 months. The Great Recession (2007 – 2009) that followed the global financial crisis was the longest period of economic contraction since the Great Depression: 18 months. Conversely, the expansion that followed the Great Recession was the longest on record, lasting more than 10 years. |

7. |

Connected, but not always in sync: Even in today’s interconnected world, individual countries can enter recessions without taking the global economy down with them. According to the International Monetary Fund, there have been only four global recessions since 1960 (compared to eight in the US in the same time frame).4 |

8. |

Bad begets good: The Federal Reserve Bank of Cleveland found that the worse a recession, the stronger the expansion that followed it. They didn’t find a connection between the length of an economic expansion and the severity of the recession that followed it.5 |

9. |

Not all stocks are created equal: Recessions impact different sectors of the economy, and the stock market, differently. The stocks of some industries are considered “cyclical” and are more impacted by the state of the economy (think discretionary purchases such as travel or a new car), while others are necessities regardless of economic cycle (think utilities). |

10. |

Stocks can grow when the economy contracts: Although bear markets sometimes coincide with recessions, stocks actually produced positive returns during seven of the 12 recessions since 1945. In fact, the S&P 500 Index returned 4.76% on average through those recessions (see chart below). |

Stocks Have Posted Positive Returns During Recessions More Often Than Not

S&P 500 Index Performance During Recessions Since 1945

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. For illustrative purposes only. Data sources: Morningstar, Ned Davis Research, and Hartford Funds, 3/20.

As you have likely noticed, the volatility of the market has reduced dramatically over the last 4-6 weeks. Although the stock market has improved somewhat during this period of time, we believe there is still opportunity for additional volatility on the horizon as many economies begin to open and we move closer to our election in November. As you have likely heard us say many times, markets do not like uncertainty. However, we encourage you to remember the work we have previously done to understand your risk tolerance, and provide historical data and perspective on risk. We encourage you to continue staying focused on your long-term goals when listening to the headlines, and know that we are always available if you would like to discuss how this is impacting your individual accounts. We continue to believe that the market will recover (like it has in the past), and we appreciate your trust in us to help you navigate through these challenging and changing times.

Our team is now back in the office, and taking extra precautions to stay safe and healthy. As your meeting time approaches in the future, we will be in touch to determine if you would like to meet in our office (our conference room table is large enough that we can sit six feet from you), or if you feel more comfortable conducting a “Zoom” meeting from the comfort of your home. We are happy to adjust our meeting to whichever venue you prefer – we want you to feel safe, but have the opportunity to discuss your financial plan and portfolio.

We are grateful for your support and your business, and we will continue to pray for your health and safety.

The S. Harris Financial Group

Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC. S. Harris Financial Group is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment advisory services offered through S. Harris Financial Group.

Raymond James Financial Services does not accept orders and/or instructions regarding your account by email, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. Email sent through the internet is not secure or confidential. Raymond James Financial Services reserves the right to monitor all email.

Any information provided in this email has been prepared from sources believed to be reliable but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in this email. This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.

Any opinions are those of S. Harris Financial Group and not necessarily those of Raymond James.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

1 The National Bureau of Economic Research (NBER) is the organization responsible for identifying economic cycles. The definition of a recession used to be two consecutive quarters of decline in real GDP, but is now more nuanced: Extended diminishing activity in real GDP (an inflation-adjusted measurement of the value of all goods and services produced by an economy), real income (inflation-adjusted measurement of how much money an individual makes), employment, industrial production, and wholesale-retail sales output.

2 Personal Consumption Expenditures/Gross Domestic Product, Federal Reserve Bank of St. Louis, as of Q42019

3 Data source for recession statistics: NBER unless otherwise noted.

4 “Collapse and Revival: Understanding Global Recessions and Recoveries,” Ayhan Kose; Marco Terrones, IMF 2015

5 “Do longer expansions lead to more severe recessions? No, say Cleveland Fed researchers,” Federal Reserve Bank of Cleveland, January 2019

Important Risks: Investing involves risk, including the possible loss of principal.