As we enter 2023, here are 3 things to consider as you manage your financial life.

1) Revisit your annual and monthly savings goals

-

- 2022 was a year of rising expenses, but higher prices only emphasize the importance of making sure you are saving enough for retirement or, if you are already retired, making sure you aren’t distributing too much from your retirement savings. Setting an annual savings/distribution goal is a great place to start. However, to make your annual savings or distribution amount a practical goal, take some time to understand what will be needed on a monthly basis to hit your goal. Reflect on 2022 and see what monthly expenses could be trimmed to increase positive cash flow. There are multiple tools available to help itemize your spending and help you determine where to cut back. It may surprise you how much of your monthly spending is going towards things that you don’t value enough to continue paying for. We often hear about how surprised people are when they add up how much they are spending on monthly streaming services or earing out. Once you set a goal for how much to pay yourself each month, consider what types of savings vehicles might be the most effective.

2) New retirement plan/account contribution limits

-

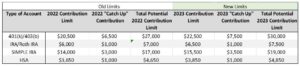

- In response to the inflation we experienced in 2022, the IRS is increasing the annual contribution limits to many retirement savings vehicles in 2023. If you are looking for a way to increase your monthly savings in 2023, adjusting the amount you are deferring to your retirement accounts could be a great place to start. Here are some of the most commonly used plans and their 2023 contribution limit increases:

-

- Note, to be eligible for a “catch-up” contribution in a 401(k), 403(b), IRA, Roth IRA, and SIMPLE IRA, you must be 50 or older. To be eligible for a “catch up” contribution to a Health Savings Account (HSA), you must be 55 or older. Also, the HSA contribution limits listed above are for individuals, the 2023 family contribution limit to an HSA is $7,750.

3) How can I bless others in 2023?

-

- The chaos and turmoil of the past few years has emphasized the need for charitable organizations around the world to step in and make an impact. Under current tax laws, it is challenging to itemize your deductions even if you donate a significant amount to charity. However, there are a few other ways to be tax-efficient with your giving. Here are some ideas:

- Bunch your giving: By combining multiple years of charitable contributions into one year, you can “Bunch” your giving. With careful planning, bunching your giving can be a way to take advantage of itemizing your gifts as a deduction on your tax return. The 2023 standard deduction for individuals is $13,850 ($27,700 for Married Filing Jointly), so to itemize your deductions, your state and local sales taxes, real estate taxes, property taxes, mortgage interest, and charitable giving must exceed those amounts. If you plan to give $5,000 this year, it’s likely that you won’t have enough itemized deductions to exceed the standard deduction. Rather than donating $5,000 to charity each year, combine two or three charitable contributions into a single year, potentially allowing your itemized deductions to exceed the standard deduction amount.

- Qualified Charitable Distributions: If you are over the age of 70 ½, this can be a tax-efficient way to give to charity. If you give funds directly from your IRA, the amount distributed to the charity does not count as taxable income for you or the charity.

- Donate stocks or bonds: If you own stocks or bonds in a taxable investment account that have a low-cost basis and significant appreciation, consider donating shares directly to charity. By giving shares directly, you could avoid potential capital gains on sales of highly appreciated securities but could also be eligible for a charitable income deduction equal to the fair market value of the security you donate, up to 30% of your AGI.

- Fund a Donor Advised Fund: A Donor Advised Fund (DAF) is a charitable account that you can create to receive your own personal charitable giving. Making a gift to a DAF provides you a current year tax deduction with the flexibility of distributing the funds in future years to qualified charities of your choosing. You could even fund a DAF with highly appreciated securities to avoid potentially large, realized capital gains in the future. At Raymond James, the minimum initial investment to establish a DAF is $10,000.

- The chaos and turmoil of the past few years has emphasized the need for charitable organizations around the world to step in and make an impact. Under current tax laws, it is challenging to itemize your deductions even if you donate a significant amount to charity. However, there are a few other ways to be tax-efficient with your giving. Here are some ideas:

If you would like to discuss any of these topics further or have any other questions, please don’t hesitate to reach out. We appreciate your continued trust in us and are excited to work alongside you in 2023. Happy New Year!

The S. Harris Financial Group

Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC. S. Harris Financial Group is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment advisory services offered through S. Harris Financial Group and Raymond James Financial Services Advisors, Inc.

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.

Raymond James Financial Services does not accept orders and/or instructions regarding your account by email, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. Email sent through the internet is not secure or confidential. Raymond James Financial Services reserves the right to monitor all email. Any information provided in this email has been prepared from sources believed to be reliable but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in this email. This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.

Any opinions are those of S. Harris Financial Group and not necessarily those of Raymond James.