April, 2018

Investment Strategy: “Secular Bull Markets”

By Jeffrey D. Saut, Chief Investment Stratgist at Raymond James

“In secular bull markets most of the surprises come on the upside.”

. . . An old stock market axiom

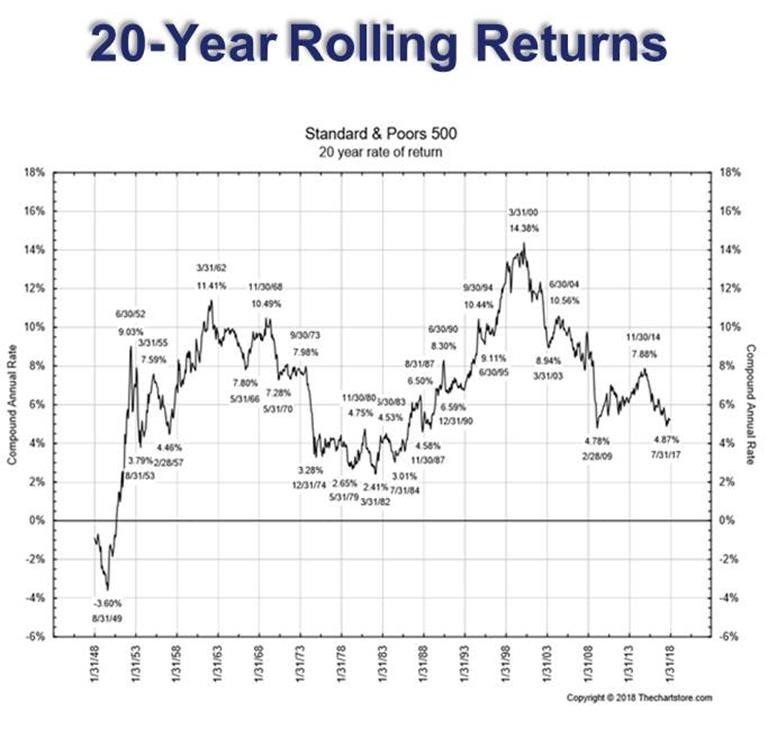

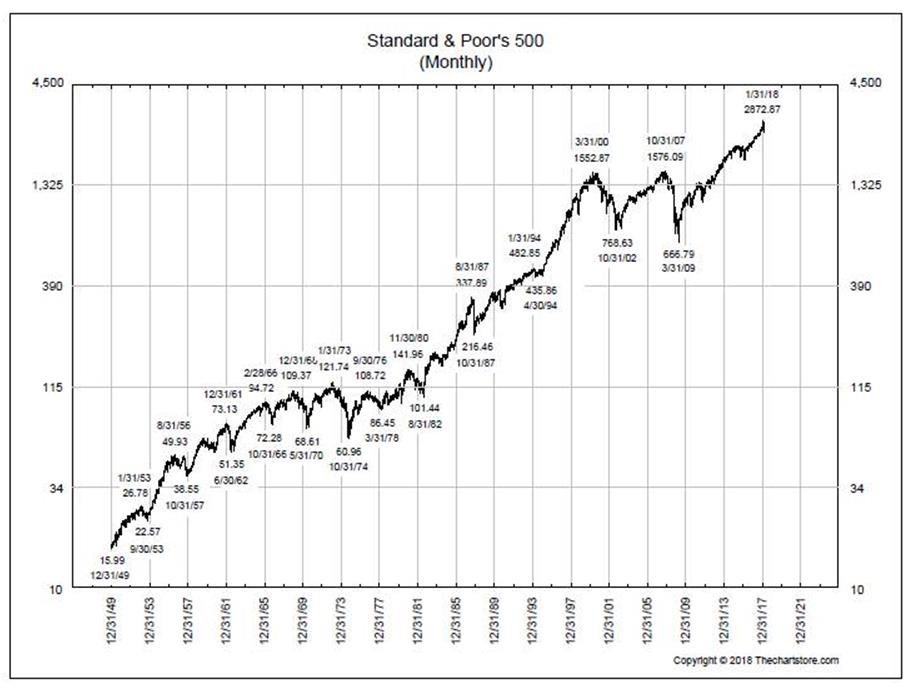

At Raymond James we offer something called a BIO visit. The acronym BIO stands for “by invitation only.” It means that clients can come to our campus in Saint Petersburg and spend a day or two meeting with senior management of this firm, select analysts, portfolio managers, investment bankers, financial planners, me . . . well you get the idea. Over the past few weeks we have done a number of these BIO visits and the ongoing question from the clients has been, “What do you mean when you say ‘secular’ bull market?” It is a valid question because most folks believe a 20% rally, or a 20% decline, represent bull and bear markets. However, that is not what a secular bull market is. Secular bull markets last 14+ years and tend to compound money at a double-digit return per year. The secular bull market of 1949 to 1966 compounded money at 11.41% per years basis the S&P 500. The 1982 to 2000 secular bull market compounded money at 14.38% using a 20-year rolling return (Chart 1). Were there pullbacks in those secular bull markets? You bet there were, but it didn’t stop the secular bull market. And there, ladies and gentlemen, is the most misunderstood point about bull markets. Most pundits cut the 1949 – 1966 Bull Run off in 1956 when the stock market took a ~21% “hit” because Egypt attempted to take over the Suez Canal, but as can be seen in Chart 2 that did not stop the bull market. Fast forward to the 1982 – 2000 secular bull market, which many participants cut off in 1987 due to the crash, but hereto that did not stop the bull market (Chart 2). We think the current secular bull market is going to be bigger than both of those secular bull markets.

It has been said that an investor will experience three secular bull markets in their life time. In the first one you will not have enough money to take advantage of it. In the third one you will be too old to take the amount of risk to really take advantage of it. Therefore, you had better take full advantage of the second bull market. Most baby boomers were not old enough to do anything with the 1949 – 1966 “run.” Moreover, most boomers did not have enough money to take full advantage of the 1982 – 2000 rally, except near the end of that Bull Run. And then most did not heed the Dow Theory “sell signal” that occurred on September 23, 1999, so they gave back much of their late-cycle gains. Consequently, they need to take full advantage of this secular bull market, which we continue to believe has years left to run. And there is yet another much misunderstood point.

Most believe this bull market began on March 9, 2009. However, the majority of stocks made their “lows” on October 10, 2008. At the time we wrote that 92.6% of all stocks traded made new annual lows. Sure, the indices went lower into March 2009, but the majority of stocks bottomed in October 2008. That is where we think the current secular bull market began. The bottoming sequence was almost classic. We made the “selling climax” low on October 10, 2008 followed by a “throwback rally,” that failed, leading to the undercut low of March 6, 2009, which was below those October 2008 selling- climax lows. As an aside, this was the same bottoming chart pattern that we identified in February 2018 when we said to buy the “undercut low” that occurred on February 9, but we digress. Such bull markets also tend to have three upside “legs” to them. We believe the first leg began in October 2008 and ended in May 2015. The second leg began in February of 2016.

The second leg is ALWAYS the longest and strongest. Once the second leg ends we should experience another upside consolidation like the one between May of 2015 and February 2016. Eventually the indices should resolve out of that consolidation on the upside and begin the third, or speculative, leg of the secular bull market. For example, the third leg of the 1982 – 2000 “run” started in late 1994 and lasted until the spring of 2000. Regrettably, there are not many of us still around that have seen a secular bull market, which is why so many refuse to trust this one. One savvy seer, however, that has seen such Bull Runs is our friend Leon Tuey, who is one of the best technical analysts on Wall Street. Recently (March 6, 2018) Leon wrote a report titled “Endless Worries.” To wit:

- One of the key features of this great bull market is investor sentiment. October 10, 2018 will be the 10th anniversary of this great bull market. Yet, from its beginning to date, investors are burdened by worries, even when there is nothing to worry about. Global depression, China’s huge debt and empty cities, the European Debt Crisis, the Arab Spring, the Japanese Tsunami and nuclear plant meltdown, Capitol Hill gridlock, the U.S. election were some of the concerns that troubled investors. More recently, they worry about inflation, Fed tightening, and trade wars. They worry endlessly. Not surprisingly, the market always climbs a wall of worry.

- In early February, fear was widespread and globally, investors panicked. Consequently, I concluded that peak selling intensity was witnessed and the market had entered a low-risk, high-reward juncture point and felt the after period of base-building, that the bull market would resume. Moreover, investors were advised to emphasize stock selection rather than worrying about the S&P 500. If you are worried, you are among the majority. Last Friday, the CNN Fear & Greed Index stood at 8, indicating extreme fear. Also, the Barron’s Insider Transaction Ratio dropped to 9. Readings below 12.1 are bullish. Moreover, last week, the AAII Sentiment Survey showed that the Bullish percent dropped to 37.3%. Furthermore, in the week of February 5, the ratio of VXV-to-VIX dropped to the lowest level on record. Also, it is interesting to note that in February, the TD Ameritrade Index registered its biggest monthly-drop ever; small investors bolted for the exit. Gripped by fear, investors panicked. Clearly, sentiment backdrop is ideal. Remember what Warren Buffett said – “Be fearful when others are greedy and be greedy when others fearful.”

- Those who are worried about the economy, don’t fret. Take a gander at the chart [Chart 4] showing the Consumer Discretionary vs. Consumer Staples. In February, this ratio hit another record high. More importantly, it broke out of a 12-year base. The breakout suggests that in the years ahead, consumer discretionary stocks will continue to outperform Consumer Staples issues, which suggests the economy will continue to improve. Therefore, the upside breakout by this ratio has bullish implications for the economy and the stock market. Accordingly, stop worrying already!

The call for this week: The S&P 500 (SPX/2786.57) has traveled back to its February 27, 2018 intraday high of 2789.15, which was where our short-term model “said” would be a near-term top a few weeks ago. At the time the stock market’s internal energy was totally used-up and needed to be rebuilt. That is not the case currently. The market’s energy now has a full charge and both the short and intermediate-term models suggest the SPX should blow through the February 27 intraday high. If that happens there is a good chance we will break out to new all-time highs. Reinforcing that sense was this email sent to me over the weekend from Leon Tuey:

Good morning, Jeffrey. I just called your office, but I didn’t think you would be working. Many are waiting for the market to bottom or a “test” not realizing the market bottomed in early February when the whole world panicked and the great bull market had resumed. Last week, the Advance-Declines [lines] for the S&P, Dow, NDX, S&P Mid-Cap, and S&P Small-Cap closed at record highs. Clearly, recent events show that investors are still haunted by the bear market of 2007-2009. Their optimism in early January was only skin-deep as optimism turned to fear almost overnight. I’ve noticed that many of the low-price biotech and high-tech issues have traced out huge bases. What that tells me is it’s a set up for a massive speculative binge at the end of this [secular] bull market. A few years ago, I told many brokers that when this bull market ends, investors will witness the greatest upside “blow-off” on record.

Like Andrew and I have repeatedly said, “No retest of the February lows!”

Chart 1

Source: The ChartStore

Chart 2

Source: The ChartStore

Chart 3

Source: Stock Charts

Chart 4

Source: Stock Charts

© 2018 Raymond James & Associates, Inc., member New York Stock Exchange/SIPC. All rights reserved.

Important Investor Disclosures

Raymond James & Associates (RJA) is a FINRA member firm and is responsible for the preparation and distribution of research created in the United States. Raymond James & Associates is located at The Raymond James Financial Center, 880 Carillon Parkway, St. Petersburg, FL 33716, (727) 567-1000. Non-U.S. affiliates, which are not FINRA member firms, include the following entities that are responsible for the creation and distribution of research in their respective areas: in Canada, Raymond James Ltd. (RJL), Suite 2100, 925 West Georgia Street, Vancouver, BC V6C 3L2, (604) 659-8200; in Europe, Raymond James Euro Equities SAS (also trading as Raymond James International), 40, rue La Boetie, 75008, Paris, France, +33 1 45 64 0500, and Raymond James Financial International Ltd., Broadwalk House, 5 Appold Street, London, England EC2A 2AG, +44 203 798 5600.

This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The securities discussed in this document may not be eligible for sale in some jurisdictions. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Investors should consider this report as only a single factor in making their investment decision.

For clients in the United States: Any foreign securities discussed in this report are generally not eligible for sale in the U.S. unless they are listed on a U.S. exchange. This report is being provided to you for informational purposes only and does not represent a solicitation for the purchase or sale of a security in any state where such a solicitation would be illegal. Investing in securities of issuers organized outside of the U.S., including ADRs, may entail certain risks. The securities of non-U.S. issuers may not be registered with, nor be subject to the reporting requirements of, the U.S. Securities and Exchange Commission. There may be limited information available on such securities. Investors who have received this report may be prohibited in certain states or other jurisdictions from purchasing the securities mentioned in this report.

Please ask your Financial Advisor for additional details and to determine if a particular security is eligible for purchase in your state.

The information provided is as of the date above and subject to change, and it should not be deemed a recommendation to buy or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. Persons within the Raymond James family of companies may have information that is not available to the contributors of the information contained in this publication. Raymond James, including affiliates and employees, may execute transactions in the securities listed in this publication that may not be consistent with the ratings appearing in this publication.

Raymond James (“RJ”) research reports are disseminated and available to RJ’s retail and institutional clients simultaneously via electronic publication to RJ’s internal proprietary websites (RJ Investor Access & RJ Capital Markets). Not all research reports are directly distributed to clients or third-party aggregators. Certain research reports may only be disseminated on RJ’s internal proprietary websites; however such research reports will not contain estimates or changes to earnings forecasts, target price, valuation, or investment or suitability rating. Individual Research Analysts may also opt to circulate published research to one or more clients electronically. This electronic communication distribution is discretionary and is done only after the research has been publically disseminated via RJ’s internal proprietary websites. The level and types of communications provided by Research Analysts to clients may vary depending on various factors including, but not limited to, the client’s individual preference as to the frequency and manner of receiving communications from Research Analysts. For research reports, models, or other data available on a particular security, please contact your RJ Sales Representative or visit RJ Investor Access or RJ Capital Markets.

Links to third-party websites are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any third-party website or the collection or use of information regarding any website’s users and/or members.

Additional information is available on request.

Analyst Information

Registration of Non-U.S. Analysts: The analysts listed on the front of this report who are not employees of Raymond James & Associates, Inc., are not registered/qualified as research analysts under FINRA rules, are not associated persons of Raymond James & Associates, Inc., and are not subject to FINRA Rule 2241 restrictions on communications with covered companies, public companies, and trading securities held by a research analyst account.

Analyst Holdings and Compensation: Equity analysts and their staffs at Raymond James are compensated based on a salary and bonus system. Several factors enter into the bonus determination including quality and performance of research product, the analyst’s success in rating stocks versus an industry index, and support effectiveness to trading and the retail and institutional sales forces. Other factors may include but are not limited to: overall ratings from internal (other than investment banking) or external parties and the general productivity and revenue generated in covered stocks.

The views expressed in this report accurately reflect the personal views of the analyst(s) covering the subject securities. No part of said person’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this research report. In addition, said analyst has not received compensation from any subject company in the last 12 months.

Ratings and Definitions

Raymond James & Associates (U.S.) definitions

Strong Buy (SB1) Expected to appreciate, produce a total return of at least 15%, and outperform the S&P 500 over the next six to 12 months. For higher yielding and more conservative equities, such as REITs and certain MLPs, a total return of at least 15% is expected to be realized over the next 12 months.

Outperform (MO2) Expected to appreciate and outperform the S&P 500 over the next 12-18 months. For higher yielding and more conservative equities, such as REITs and certain MLPs, an Outperform rating is used for securities where we are comfortable with the relative safety of the dividend and expect a total return modestly exceeding the dividend yield over the next 12-18 months.

Market Perform (MP3) Expected to perform generally in line with the S&P 500 over the next 12 months.

Underperform (MU4) Expected to underperform the S&P 500 or its sector over the next six to 12 months and should be sold.

Suspended (S) The rating and price target have been suspended temporarily. This action may be due to market events that made coverage impracticable, or to comply with applicable regulations or firm policies in certain circumstances, including when Raymond James may be providing investment banking services to the company. The previous rating and price target are no longer in effect for this security and should not be relied upon.

Raymond James Ltd. (Canada) definitions

Strong Buy (SB1) The stock is expected to appreciate and produce a total return of at least 15% and outperform the S&P/TSX Composite Index over the next six months.

Outperform (MO2) The stock is expected to appreciate and outperform the S&P/TSX Composite Index over the next twelve months.

Market Perform (MP3) The stock is expected to perform generally in line with the S&P/TSX Composite Index over the next twelve months and is potentially a source of funds for more highly rated securities.

Underperform (MU4) The stock is expected to underperform the S&P/TSX Composite Index or its sector over the next six to twelve months and should be sold.

Raymond James Europe (Raymond James Euro Equities SAS & Raymond James Financial International Limited) rating definitions

Strong Buy (1) Expected to appreciate, produce a total return of at least 15%, and outperform the Stoxx 600 over the next 6 to 12 months.

Outperform (2) Expected to appreciate and outperform the Stoxx 600 over the next 12 months. Market Perform (3) Expected to perform generally in line with the Stoxx 600 over the next 12 months. Underperform (4) Expected to underperform the Stoxx 600 or its sector over the next 6 to 12 months.

Suspended (S) The rating and target price have been suspended temporarily. This action may be due to market events that made coverage impracticable, or to comply with applicable regulations or firm policies in certain circumstances, including when Raymond James may be providing investment banking services to the company. The previous rating and target price are no longer in effect for this security and should not be relied upon.

In transacting in any security, investors should be aware that other securities in the Raymond James research coverage universe might carry a higher or lower rating. Investors should feel free to contact their Financial Advisor to discuss the merits of other available investments.

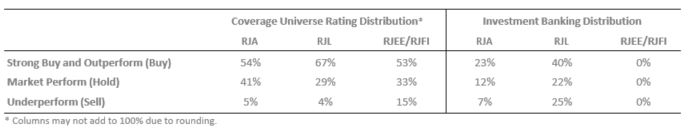

Rating Distributions

Suitability Ratings (SR)

Medium Risk/Income (M/INC) Lower to average risk equities of companies with sound financials, consistent earnings, and dividend yields above that of the S&P 500. Many securities in this category are structured with a focus on providing a consistent dividend or return of capital.

Medium Risk/Growth (M/GRW) Lower to average risk equities of companies with sound financials, consistent earnings growth, the potential for long-term price appreciation, a potential dividend yield, and/or share repurchase program.

High Risk/Income (H/INC) Medium to higher risk equities of companies that are structured with a focus on providing a meaningful dividend but may face less predictable earnings (or losses), more leveraged balance sheets, rapidly changing market dynamics, financial and competitive issues, higher price volatility (beta), and potential risk of principal. Securities of companies in this category may have a less predictable income stream from dividends or distributions of capital.

High Risk/Growth (H/GRW) Medium to higher risk equities of companies in fast growing and competitive industries, with less predictable earnings (or losses), more leveraged balance sheets, rapidly changing market dynamics, financial or legal issues, higher price volatility (beta), and potential risk of principal.

High Risk/Speculation (H/SPEC) High risk equities of companies with a short or unprofitable operating history, limited or less predictable revenues, very high risk associated with success, significant financial or legal issues, or a substantial risk/loss of principal.

Raymond James Relationship Disclosures

Raymond James expects to receive or intends to seek compensation for investment banking services from the subject companies in the next three months.

Stock Charts, Target Prices, and Valuation Methodologies

Valuation Methodology: The Raymond James methodology for assigning ratings and target prices includes a number of qualitative and quantitative factors including an assessment of industry size, structure, business trends and overall attractiveness; management effectiveness; competition; visibility; financial condition, and expected total return, among other factors. These factors are subject to change depending on overall economic conditions or industry- or company-specific occurrences.

Target Prices: The information below indicates target price and rating changes for the subject companies included in this research.

Risk Factors

General Risk Factors: Following are some general risk factors that pertain to the businesses of the subject companies and the projected target prices and recommendations included on Raymond James research: (1) Industry fundamentals with respect to customer demand or product / service pricing could change and adversely impact expected revenues and earnings; (2) Issues relating to major competitors or market shares or new product expectations could change investor attitudes toward the sector or this stock; (3) Unforeseen developments with respect to the management, financial condition or accounting policies or practices could alter the prospective valuation; or (4) External factors that affect the U.S. economy, interest rates, the U.S. dollar or major segments of the economy could alter investor confidence and investment prospects. International investments involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability.

Additional Risk and Disclosure information, as well as more information on the Raymond James rating system and suitability categories, is available at rjcapitalmarkets.com/Disclosures/index. Copies of research or Raymond James’ summary policies relating to research analyst independence can be obtained by contacting any Raymond James & Associates or Raymond James Financial Services office (please see raymondjames.com for office locations) or by calling 727-567-1000, toll free 800-237-5643 or sending a written request to the Equity Research Library, Raymond James & Associates, Inc., Tower 3, 6th Floor, 880 Carillon Parkway, St. Petersburg, FL 33716.

Simple Moving Average (SMA) – A simple, or arithmetic, moving average is calculated by adding the closing price of the security for a number of time periods and then dividing this total by the number of time periods.

Exponential Moving Average (EMA) – A type of moving average that is similar to a simple moving average, except that more weight is given to the latest data.

Relative Strength Index (RSI) – The Relative Strength Index is a technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Small-cap stocks generally involve greater risks. Dividends are not guaranteed and will fluctuate. Past performance may not be indicative of future results.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds and exchange-traded funds carefully before investing. The prospectus contains this and other information about mutual funds and exchange –traded funds. The prospectus is available from your financial advisor and should be read carefully before investing.

Not approved for rollover solicitations.

For clients in the United Kingdom:

For clients of Raymond James Financial International Limited (RJFI): This document and any investment to which this document relates is intended for the sole use of the persons to whom it is addressed, being persons who are Eligible Counterparties or Professional Clients as described in the FCA rules or persons described in Articles 19(5) (Investment professionals) or 49(2) (High net worth companies, unincorporated associations etc) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) or any other person to whom this promotion may lawfully be directed. It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons and may not be relied upon by such persons and is therefore not intended for private individuals or those who would be classified as Retail Clients.

For clients of Raymond James Investment Services, Ltd.: This report is for the use of professional investment advisers and managers and is not intended for use by clients.

For purposes of the Financial Conduct Authority requirements, this research report is classified as independent with respect to conflict of interest management. RJFI, and Raymond James Investment Services, Ltd. are authorised and regulated by the Financial Conduct Authority in the United Kingdom.

For clients in France:

This document and any investment to which this document relates is intended for the sole use of the persons to whom it is addressed, being persons who are Eligible Counterparties or Professional Clients as described in “Code Monétaire et Financier” and Règlement Général de l’Autorité des Marchés Financiers. It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons and may not be relied upon by such persons and is therefore not intended for private individuals or those who would be classified as Retail Clients.

For clients of Raymond James Euro Equities: Raymond James Euro Equities is authorised and regulated by the Autorité de Contrôle Prudentiel et de Résolution and the Autorité des Marchés Financiers.

For institutional clients in the European Economic Area (EEA) outside of the United Kingdom:

This document (and any attachments or exhibits hereto) is intended only for EEA institutional clients or others to whom it may lawfully be submitted.

For Canadian clients:

This report is not prepared subject to Canadian disclosure requirements, unless a Canadian analyst has contributed to the content of the report. In the case where there is Canadian analyst contribution, the report meets all applicable IIROC disclosure requirements.

Proprietary Rights Notice: By accepting a copy of this report, you acknowledge and agree as follows:

This report is provided to clients of Raymond James only for your personal, noncommercial use. Except as expressly authorized by Raymond James, you may not copy, reproduce, transmit, sell, display, distribute, publish, broadcast, circulate, modify, disseminate or commercially exploit the information contained in this report, in printed, electronic or any other form, in any manner, without the prior express written consent of Raymond James. You also agree not to use the information provided in this report for any unlawful purpose.

This report and its contents are the property of Raymond James and are protected by applicable copyright, trade secret or other intellectual property laws (of the United States and other countries). United States law, 17 U.S.C. Sec.501 et seq, provides for civil and criminal penalties for copyright infringement. No copyright claimed in incorporated U.S. government works.

Raymond James Financial Services, Inc. does not guarantee that the foregoing material is accurate or complete. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Investments mentioned may not be suitable for all investors. The material is general in nature. Past performance may not be indicative of future results. Raymond James Financial Services, Inc. does not provide advice on tax, legal or mortgage issues. These matters should be discussed with the appropriate professional.

Securities offered through Raymond James Financial Services, Inc ., Member FINRA/SIPC. S. Harris Financial Group is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment advisory services offered through S. Harris Financial Group.