The market so far in 2022 looks vastly different than the 18-month run which began in late March 2020. The increase in volatility likely has you paying more attention to the headlines and your monthly investment statements. It is important to remember, though, that when you have a diversified portfolio designed for longer-term goals, historical data shows that one of the worst mistakes investors can make in volatile markets is getting out of the market.

So, what is happening this year that is making the markets more volatile than we have seen in at least two years? Here are some of the uncertainties that the market has been digesting and pricing in since January:

- Inflation: I’m sure you are feeling the increase in grocery and fuel prices, among other things. The return of a 50-year low unemployment rate, a significant amount of extra cash that was pumped into our economy during the pandemic, and the prolonged supply chain issues we are experiencing has driven prices up, thus creating the highest inflation we have experienced in approximately 40 years.

- Increase in interest rates: The Fed raised rates 0.25% in March, and we expect another 0.5% increase in May and June, with 3-4 additional increases later this year. Because inflation has increased so significantly over a short period of time and the Fed has realized that it is more “sticky” inflation than it originally hoped, they have changed their timing for increasing interest rates dramatically over the last 6-8 months.

- Russia-Ukraine conflict: Russia’s contribution of energy and food products to the world economy are contributing to the inflation in oil and food prices. With many questions regarding the length of this conflict or the result, the markets are also pricing in this ambiguity.

Even with all the uncertainties that we are experiencing, the downside volatility of 14% that the S&P 500 has seen so far this year is in line with the average intra-year decline of 14% over the last 42 years. Thus, though it feels dramatic compared to what we experienced in late-2020 and most of 2021, it is in range with an average year’s volatility. Also keep in mind that the S&P 500 is down only 0.5% since this time last year.

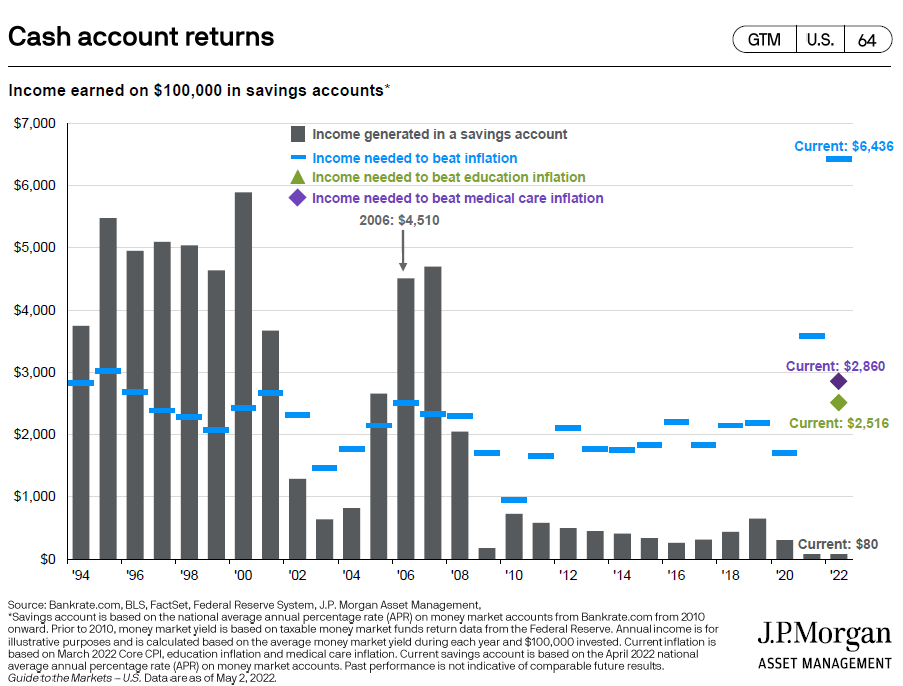

It might be tempting to get off this roller coaster ride and put your money in something “safe”. However, it is important to note that the current low interest rates on cash (see the gray bars in the chart below) coupled with the increase in inflation (represented by the blue lines below) mean you are losing significant purchasing power on any long-term funds that are “parked” in cash. As an example, the current average annual interest income of $80 on $100,000 sitting in a savings account is significantly lower than the $6,436 that you would need to earn on your savings just to keep up with inflation. Therefore, even though the excess cash you may have in your bank account makes you feel “safe” from market risk, it is important to understand it is subject to the largest inflation risk we have seen in 40 years.

Please know there is also some good news for the stock market – as of last week, 72% of S&P 500 companies that have reported earnings results this quarter have delivered results in line or better than analysts expected. Since many companies were forced to reduce their expenses during the pandemic, and we currently have historically low corporate tax rates, corporate earnings have increased, and analysts expect that trend to continue throughout 2022 and into 2023.

However, the market closed down last week due to the release of the first quarter’s negative GDP growth report. Since a recession is typically defined as two consecutive quarters of negative GDP growth, this surprise in the data spooked the stock market. The 1.4% decline was a big swing from the previous quarter’s strong 6.9% growth. While the economy shrank, there are some silver linings in that both consumer spending and business investment increased for the quarter, 2.7% and 9.7% respectively. These are the backbone to any economy and still show strong growth despite high inflation. On the other hand, the net exports number of -3.2% detracted significantly from the overall GDP results. We believe this decline is a result of many of the ships that were previously stuck offshore have now been able to unload their goods, thus creating a net import in goods, which detracts from the overall GDP number.

We encourage you to remember all the work we have done building the foundation for your long-term investment portfolio: your risk tolerance questionnaire, discussions about historical volatility and downturns, and diversification of asset classes and managers. We built that foundation for these types of market conditions. We are monitoring the markets and your investments, and we will reach out if we believe we should make any tweaks to your portfolio.

So, what can you do in the meantime? Since none of us can predict the market, we recommend you focus on the things you can control:

- Monitor your expenses, making reductions where possible.

- If you anticipate a need for cash from your investment portfolio in the next 12 months, let us know so we can discuss a plan to set those funds aside in cash.

- Stay the course, and remember we planned for this volatility.

We appreciate your business and are here to serve you. We will be reviewing these items in more detail during your upcoming meeting, but please know that you are welcome to call us if you would like to discuss anything further in the meantime.

We are grateful for your support and your business, and we will continue to pray for your health and safety.

The S. Harris Financial Group

Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC. S. Harris Financial Group is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment advisory services offered through S. Harris Financial Group.

Raymond James Financial Services does not accept orders and/or instructions regarding your account by email, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. Email sent through the internet is not secure or confidential. Raymond James Financial Services reserves the right to monitor all email. Any information provided in this email has been prepared from sources believed to be reliable but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in this email. This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.

Any opinions are those of S. Harris Financial Group and not necessarily those of Raymond James.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

Important Risks: Investing involves risk, including the possible loss of principal.