The talking heads can’t stop talking about it: Inflation. While much of what the “news” says is exaggerated, lacking context, and meant to keep you coming back for more, there is no denying we are experiencing higher inflation than what we have experienced in a long time. You have probably noticed the grocery bill go up or that it costs more to fill up your car recently. Small business assistance through PPP loans/grants, stimulus checks, and Federal reserve bond buying have all lead to a dramatic increase in the number of dollars in our economy. Add to that our historically low interest rates and supply chain issues stemming from the economic shutdown in 2020, and you have a classic recipe for inflation. Everything I just listed as a cause for inflation is probably out of your control, so how should you respond?

1. Focus on what you can control

Dallas Cowboys legend Emmitt Smith tells a story about the best money advice he ever received, claiming it was from non-other than Cowboys owner Jerry Jones:

“He taught me about finances with a simple statement. He always said, ‘Have a big front door and a small back door. Take in as much as you can and spend as little as you can.’” – Emmitt Smith

While simple, that philosophy is the perfect example of easier said than done. With a steady income, saving money is very doable, but the temptations of going out with friends, buying or leasing a nice new car, or anything else that doesn’t contribute to the goal of financial independence is only going to be more costly and painful with rising inflation. I’m not saying don’t buy nice things, don’t enjoy time with friends, or go on nice trips. I am saying to focus on what you can control by creating a spending plan and sticking to it. Budgeting for those “fun” things helps you keep spending in check and creates the freedom to enjoy those things because you know they are part of the plan and not preventing you from building wealth.

2. Don’t try to time the market

The desire to liquidate holdings or invest funds when you believe something is going to happen in the short-term rarely proves to be an effective strategy. There are many times in history that headlines could make one weary of investing, but hindsight shows us that people sitting out of the market experienced significant opportunity cost during many of those times. To successfully “time the market” you must make two great calls; when to sell and when to buy back in. Individuals rarely make both those calls correctly. A study published in the February 2001 issue of Financial Analysts’ Journal, titled Market Timing and Roulette Wheels, tested and compared the results between the market timing and buy-and-hold strategies. The authors studied data from 1926 through 1999, in an examination that included all six major U.S. asset classes. The objective: To determine whether market timing was an effective strategy. This study was revisited in 2012. They analyzed a variety of monthly, quarterly, and annual market timing strategies, producing more than one million possible market timing sequences with more than one million different outcomes. Each of these outcomes was compared to the buy-and-hold strategy for the same time period. The study of a million-plus investing scenarios concluded that the buy-and-hold strategy beat market timing 99.8% of the time.

3) Don’t sit on excess cash

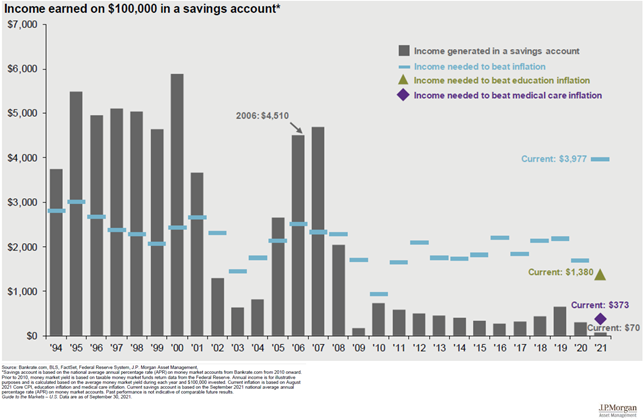

One of the most painful parts of experiencing inflation is seeing the purchasing power of your dollars go down. Compounding this issue is the fact that checking accounts, savings accounts, and even CDs all have historically low interest rates. The chart below illustrates this:

It’s evident that through much of the 90s, and even some of the mid 2000s, it was possible that cash in the bank could have earned enough to beat inflation. Since interest rates were lowered in response to the financial crisis in 2008, we have never returned to a point where you could make enough in the bank (the gray bars above) to outpace the cost that your living expenses are going up (the blue lines above). Of course, your emergency fund and money for anticipated upcoming expenses should be kept in cash. However, investing for the long term has been one of the best ways to keep pace and sometimes exceed inflation over time for the money you will need in your later years. Does this mean we recommend putting all your money in the stock market then never touching it again? Absolutely not, as plans need to be adjusted to your goals and risk tolerance over time. However, we believe a well-thought-out diversification strategy and periodic rebalancing is still the fundamental basis of a good investment plan. In times of uncertainty, sticking to a disciplined investment approach utilizing strategic, diversified asset allocation will hopefully allow you to benefit the best days in the market that can be critical to a portfolio’s long-term performance.

Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC. S. Harris Financial Group is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment advisory services offered through Raymond James Financial Services Advisors, Inc and S. Harris Financial Group.

Raymond James Financial Services does not accept orders and/or instructions regarding your account by email, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. Email sent through the internet is not secure or confidential. Any information provided in this article has been prepared from sources believed to be reliable but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in this article.

Any opinions are those of S. Harris Financial Group and not necessarily those of Raymond James.