At S. Harris Financial Group, our team takes a holistic approach to help individuals and families define and build legacies by aligning financial assets with family goals and values. In doing so, we prepare our clients for expected and unexpected events in life. We have a personal call to action; we have lived and breathed our own advice. We have experienced life’s great joys: marriage, childbirth, education, and retirement, but we have also experienced life’s most difficult times: a near-death accident, illness, disabilities, death, and divorce; fortunately, we were prepared. With these experiences we are passionate and understand the importance of being prepared for all of life’s events.

Financial Planning / Wealth Management

Building Your Legacy

One of the most rewarding aspects of wealth is sharing it with others. Through careful assessment of your individual aspirations, a thoughtfully planned strategy can be crafted, with tax efficient investments, to help achieve your goals. Whether your desire is to create a multigenerational wealth preservation and transition plan for your family, provide funding to a charitable entity, or provide for a family member’s higher education, we have access to a variety of tools to help address your legacy and wealth transfer concerns.

- Trust and Estate Planning Strategies: We can provide estate-planning analysis. With the resources of trust companies at our disposal, we can assist clients in trust planning and leverage the expertise of a professional fiduciary.

- Charitable Strategies: While many individuals give to charity, few take the time to create a well-designed charitable strategy that considers personal tax benefits and control over your investments. We can assist with strategies such as: Charitable Remainder Trusts, Charitable Lead Trusts, Pooled Income Funds, Charitable Gift Annuities, Donor Advised Funds and Private Family Foundations.

- Education Funding: As the cost of a college education continues to climb, many grandparents are stepping in to assist. Financially contributing to a grandchild’s college education can bring great personal satisfaction and can be a smart way for grandparents to pass on wealth in a tax efficient manner. We can help you sort through the many tools available to accomplish this goal and determine which option is right for your individual situation.

Preserving Your Wealth

S. Harris Financial Group offers exclusive resources for clients with significant assets and complex financial situations. Our team of professionals, in conjunction with the vast resources of Fidelity and other investment companies, can address many different areas such as:

- significant wealth events (sale of a family business, retirement with significant assets, handling a large inheritance, etc.)

- complex legacy planning and charitable giving design

- large concentrations in a single security

- portfolios with sophisticated investment strategies

- large cash portfolios

- tax mitigation strategies

- asset preservation strategies

- exit strategies for business owners

- use of trusts for estate planning

We offer customized solutions to these planning needs.

Retirement Planning

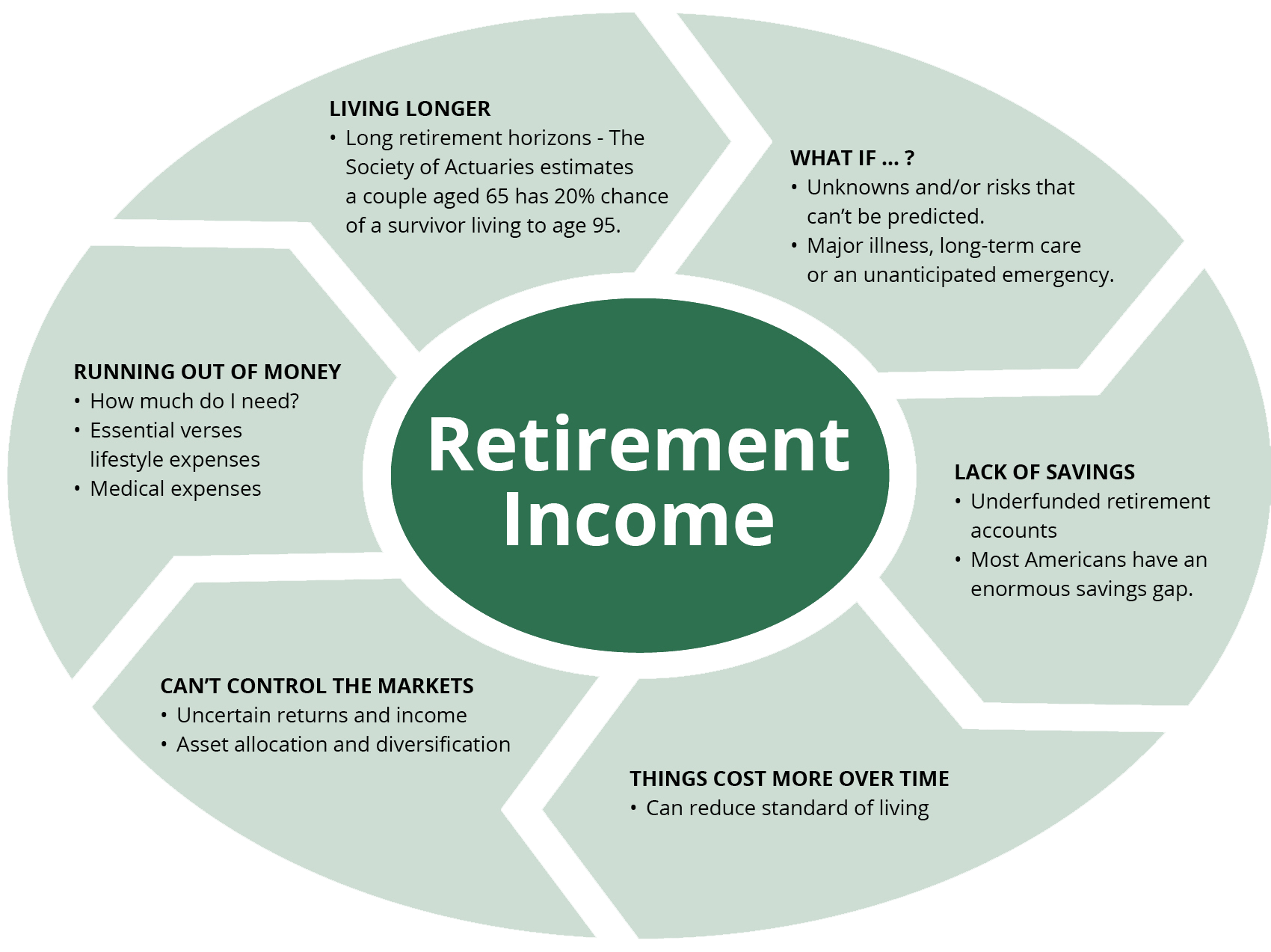

Today more than ever there is increasing need for effective planning, particularly with regard to retirement. We generally see three main drivers creating retirement challenges:

- People are living longer

- Unrealistic expectations for retirement living expenses

- People have not saved enough.

Our process aims to mitigate these risks.

Investment Management

Investment Solutions

- S. Harris Financial Group implements our investment process through the use of a variety of tools depending on your objectives, risk tolerance, time horizon, tax situation and investment experience. We believe a fully integrated plan of investments, built on each client’s circumstances, stage in life and goals is the most appropriate way to reach the optimal investment solution.

Portfolio Construction Process

- By understanding each client’s goals and tolerance for financial risk, S. Harris Financial Group is able to design an optimal portfolio. We often find new clients that are taking on considerably more risk than they are comfortable with; or, not taking enough risk for their long-term goals, because they do not have an understanding of the need for this risk. We build a portfolio depending on the client’s situation and needs, to provide diversification and seek to reduce their overall risk to the market. We then monitor the accounts to ensure they are providing the expected results, and ensure our projections are adjusted as needed.

“Have no doubt, we will be monitoring your portfolio and watching the market so we are ready to respond should the need arise. However, we believe having a consistent, diligent process is the key to wealth management as it helps to alleviate emotional decisions. Research shows that clients often react emotionally to market movements, subsequently missing out on returns in the short-term. Therefore, one of our largest responsibilities for our clients is to help them see these market changes in light of their long-term financial goals.“ Stephanie Harris.

Professional Asset Management

- S. Harris Financial Group utilizes Fidelity Investments’ RIA platform to provide professional asset management, with one of the widest platforms of mutual funds and money managers in the United States. This allows us access to select and employ from the broadest base of professional money manager available in the industry, based on our rigorous process in the identifying and evaluating managers. Additionally they provide ongoing due diligence and research. The “open architecture” enables us to select funds and managers based on their merits and free from the “quotas” or “pushes” of proprietary products that occurs at other firms.

Divorce Financial Analysis

When divorce is inevitable, making the right financial decisions is critical. However, lack of financial knowledge frequently drives people to agree to a divorce settlement they may not fully understand or may regret in the future. Once a divorce settlement has been signed, it is very difficult, or impossible, to change it.

We help clients understand the long-term effects of their divorce settlement. Decisions made during a divorce are often the result of legal negotiations that take place at a time when emotions are at an all-time high. One of the most difficult things to deal with when going through a divorce is separating these emotions from the task at hand.

Divorce Planning / Certified Divorce Financial Analyst® (CDFA®)

A CDFA® professional is a financial professional who specializes and is skilled at analyzing data and providing expertise on the financial issues of divorce. The role of the CDFA® professional is to assist the client and his or her attorney to understand how the decisions he or she makes today will impact the client’s financial future. A CDFA® can take on many roles in the divorce process:

Financial Expertise and Strategy

CDFA® professionals provide the client and attorney with data analysis that shows the financial effect of any given settlement. They become part of the divorce team and provide support on financial issues such as:

- Understanding the short-term and long-term effects of dividing property.

- Analyzing pensions and retirement plans.

- Determining if the client can afford the marital home, and if not, what he or she can afford.

- Recognizing the tax consequences of different settlement proposals.

Data Collection and Analysis

Much of a CDFA® professional’s role is collect the client’s financial data and perform analysis. CDFAs can help manage a client’s expectations of their financial future by presenting different scenarios and talking through the client’s budget and expenses. CDFAs are trained to:

- Collect financial and expense data.

- Help clients identify their future financial goals.

- Develop a budget.

- Set retirement objectives.

- Determine how much risk they are willing to take with their investments.

- Identify what kind of lifestyle they want.

Expert Witness, Mediation and Litigation Support

In some cases, CDFA professionals are called upon to act as expert witnesses in court and/or participate in mediation proceedings.

Business Solutions

For business owners, S. Harris Financial Group, with additional tools, resources, and products available on Fidelity Investments’ RIA platform, creates innovative solutions for challenges facing their company.

- Family and Business Succession and Transition Planning: Depending on the business owner’s goal, be that sale, intra-family transfer or liquidation, we specialize in counseling business owners through the exit planning process.

- Retirement / 401(k) Plans: Harris Financial Group can provide counseling on retirement plans appropriate for your company’s situation and advise on plan format and design, and investment options.

- Investment Banking/Corporate Finance: For businesses in need of capital market expertise and advisory work, we have relationships with investment banks that can be engaged to assist.

- Commercial Banking: Banking partnerships offer an array of corporate and real estate lending programs designed to suit a variety of needs to businesses in all 50 states.

Second Opinion Service

In these volatile times, how is your financial health? The ups and downs of the stock market, the politics in Washington D.C., and the “media mania” may be taking a toll on you in more than one way. Times like these can be overwhelming and leave you with questions like:

- Am I still on track to meet my financial goals and objectives?

- How can I help protect my investments from this uncertainty?

- What actions should I be taking?

- Is it time to be opportunistic?

Over our 20+ years in this business, many people have reached out to us asking for a second opinion – either because they are managing their financial picture themselves and feel unsure about navigating through challenging times, or because they are not confident with the communication or decisions of their current financial advisor. If you are not confident in your long-term financial plan, we recommend you seek a second opinion.

If your interested in a complementary second opinion, we have a simple two-2 step process:

Step 1:

- Complete our 5-10 minute Second Opinion Questionnaire <Click Here>.

- Provide us copies of your most recent statements via email, fax or drop them at the office (company retirement plans, IRAs, Brokerage accounts, etc.)

- Complete the risk tolerance questionnaire we email you.

Step 2:

- Our team of CERTIFIED FINANCIAL PLANNER™ professionals will review your accounts & questionnaire responses.

- We will develop feedback for your situation and coordinate a one-hour session to review our analysis.

We are focused on delivering value. So, if you are in good shape, we are happy to share that news with you. If you see value that we can add, we would be happy to discuss. Either way, we believe that you will find benefit in the time you invest by having more conviction and confidence in your plan going forward.

Contact Us

If you would like to understand more about the services we offer and how we might serve you, please contact us today.